At SHEBA Accounting, we stand for integrity, precision, and professionalism.

Recordkeeping and document maintenance are among the core strengths of SHEBA Accounting. The firm provides clients with organized, neat, and easily accessible compilation of business transaction records and documents. Following ISO standards for documentation, SHEBA Accounting designs company policies and procedures that align with document workflows and secure storage practices.

The firm handles the compilation and bookkeeping of business transactions as well as the preparation of financial reports, including Financial Statements and Statements of Cash Flows, delivered in a timely manner. These reports are critical for reliable management decision-making.

We ensure that financial statements are readily available, allowing clients to access their Quarterly and Annual Tax Reports for use by internal or external stakeholders.

SHEBA Accounting, through its External Audit Services, is an accredited external auditor recognized by the Board of Accountancy and the Professional Regulation Commission. The firm has also obtained various external auditor accreditations from multiple government agencies, enabling us to serve a wide range of industries and business sectors.

Our external audits focus on examining financial statements, ensuring their preparation and fair presentation in accordance with Generally Accepted Accounting Principles (GAAP) and the Philippine Financial Reporting Standards (PFRS).

SHEBA Accounting also provides internal audit services, including the design and setup of accounting processes, and the creation of tailored accounting manuals, policies, procedures, and controls specific to client operations. The firm reports to client management on the assessment of the accounting department, evaluates processes, and recommends more efficient and effective accounting practices.

Additionally, SHEBA Accounting conducts tests of controls and assesses process flows to ensure proper checks and balances. We also handle specific engagements as requested by clients to improve and optimize operational efficiency.

As a diverse and comprehensive service provider, SHEBA Accounting Business Consultancy and Tax Services, together with its Regulatory Services Department, offers the following services efficiently and expeditiously:

Business registration, renewals, and closures (both temporary and permanent)

Specialized tax services, including tax assessments, case management, and representation before government agencies

Corporate business transactions, including mergers and acquisitions

Sale and transfer of businesses

Preparation and provision of specialized documents

Facilitation of ventures, investments, and capital acquisition

Actuarial services, pricing, and business valuations

Other specialized services tailored to client needs

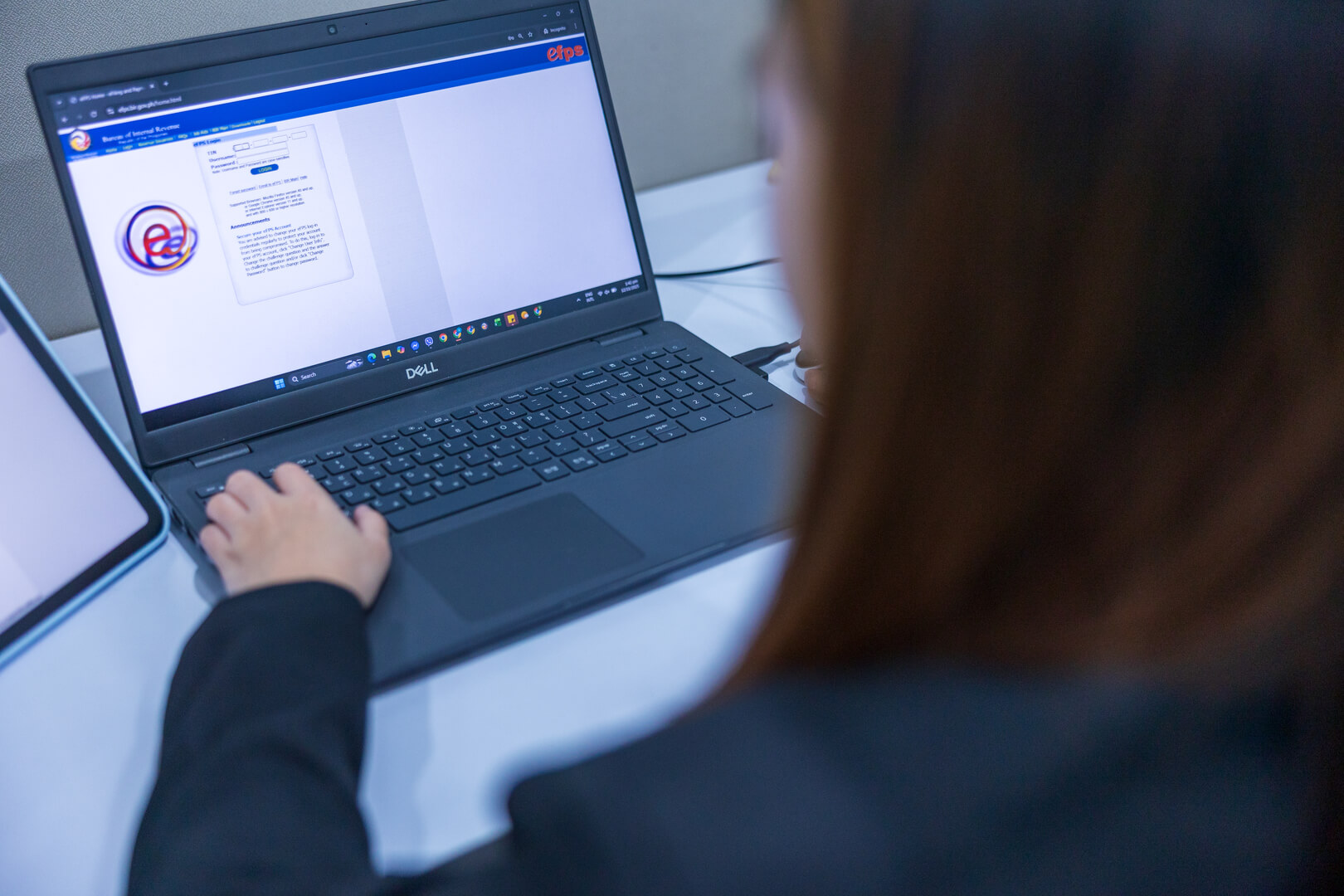

As an experienced provider of outsourced payroll services and statutory compliance, our firm ensures timely and accurate computation of payroll details. We support our clients throughout the payroll process, including uploading payroll sheets to designated client accounts, and take responsibility for notifying clients in advance regarding payroll funding to prevent delays or insufficient funds.

We take full accountability for any errors and implement precautionary measures—on our side or with the client—to prevent recurrence. Additionally, we report to management on trends and provide explanations for significant fluctuations in payroll compared to regular periods.

Outsourced billing and accounts receivable collections are among the most specialized services offered by SHEBA Accounting Business Consultancy and Tax Services. The firm provides these services to numerous clients, particularly those with delinquent or dormant accounts. Together with the client, we establish targets and develop strategic plans for collections and recovery of accounts receivable.

SHEBA Accounting manages the full cycle of cash realization, from billing to collections, while maintaining receivables in their current position. The firm ensures strong relationships with client customers, addressing defaults effectively and maintaining open communication to facilitate smooth business transactions.

SHEBA Accounting Business Consultancy and Tax Services, through its service department, offers outsourced accounts payable and liability management solutions. The firm is highly experienced in managing payables and reporting cash positions to clients in relation to disbursements and payments.

We are equipped to handle a large volume of accounts payable transactions daily, processing, scrutinizing, and verifying accounts with accuracy and attention to detail. As a seasoned service provider, we ensure strict compliance with check issuance processes to suppliers, preventing unfunded expenditures.

The firm prepares monthly summary reports of disbursements, including classification of accounts in the income statement or balance sheet. Additionally, we maintain company records, ensuring documents are securely stored, preserved, and easily accessible for future use by internal or external stakeholders.